Ozark Market Data, Sites, & Land

Ozark, Missouri, stands out as a strategic hub for business growth.

Located between Springfield and Branson, the city offers direct access to U.S. Highway 65, simplifying regional and national connections. A strong local workforce, a supportive business community, and a steadily expanding economic landscape make Ozark a prime location to establish or grow operations.

Ozark at a Glance

Explore Ozark’s Key Advantages

Discover the data that drives development in Ozark—population trends, workforce insights, infrastructure details, and more—followed by current sites, buildings, and land opportunities ready for investment.

Data sourced from 2023 reports and public datasets.

Population

2.3% 1-year growth

Median Age

1.21% 1-year increase

Median HH Income

4.11% 1-year growth

Median Home Value

6.76% 1-year growth

Working Population

2.15% 1-year growth

Poverty

12% 1-year increase

Economy

Ozark’s economy is part of a larger, interconnected Christian County workforce, with 10,500 jobs in Ozark and 44,200 across the county. The region’s employment base is rooted in healthcare, retail, and education, which consistently rank as the top industries in both Ozark and Christian County. This alignment reflects a strong, service-driven workforce supported by schools, medical providers, and retail centers that serve residents throughout the area.

Higher-earning opportunities are found in professional, scientific, and technical services, with Ozark also showing strong wages in wholesale trade, while the county overall sees its highest median earnings in utilities and finance and insurance. Together, these sectors contribute to a balanced and resilient local economy.

Data sourced from 2023 reports and public datasets.

Housing & Living

Ozark’s housing market continues to grow, with a median home value of $230,600 in 2023, reflecting a 6.76% increase from the previous year. Christian County’s median value is slightly higher at $249,700, and both remain below the national average, offering relative affordability in a rapidly growing region. Homeownership is strong across the area, with 66.2% of Ozark residents and 76% of Christian County residents owning their homes—both above the national rate.

Commuting patterns also show similarity across the region. Ozark residents average a 23.6-minute commute, while Christian County averages 25.1 minutes, with most people driving alone and maintaining about two cars per household, closely mirroring national trends.

Income levels remain a notable strength for the county overall. Christian County’s median household income is $81,245, with several census tracts exceeding $87,000–$102,000—well above state and regional benchmarks. Housing stability has also improved over time, with 10.4% of the population experiencing severe housing problems in 2025, a decrease of 1.7% since 2014, reflecting gradual improvements in affordability and living conditions across the county.

For more interactive charts—including home values, property taxes, commute patterns, and housing characteristics—visit DataUSA’s Ozark housing dashboard.

Data sourced from 2023 reports and public datasets.

Local Tax Snapshot

Ozark, MO — Sales & Use Tax (2025)

| Base combined sales tax | 8.35% |

|---|---|

| Breakdown | State 4.225% · County/ESD 1.75% · City 2.375%[1] |

| Special districts (examples) | Most CIDs/TDDs: 9.35%. Town & Country Village (CID+TDD): 10.35%.[2] |

| Use tax (delivered/remote) | Base 4.225% (state only). Some districts (e.g., Town & Country Village, Deerbrook) show total 5.225% due to a 1% local use tax.[2] |

Check an exact address/rate with the MO DOR sales/use portal (includes address lookup).

Ozark, MO — Property Tax

| Who bills/collects? | Christian County Collector. The City of Ozark does not bill or collect taxes.[3] |

|---|---|

| Due date | Tax statements mailed in November; due by Dec 31 (postmark rules apply).[4] |

| Assessment ratios (MO) | Residential 19% · Commercial 32% · Agricultural 12% of market value.[5] |

| Commercial real estate surtax | 0.34% of assessed value (countywide).[6] |

| City median (informational) | Effective rate ≈ 1.09%; median bill ≈ $1,665 on median value ≈ $159,100.[7] |

Christian County, MO — Countywide Tax Info

| Unincorporated base sales tax | 5.975% (State 4.225% + County/ESD 1.75%).[2] |

|---|---|

| Use tax (delivered/remote) | 4.225% (state only; no county local use tax).[2] |

| Domestic utilities | 0.25% (per DOR “Domestic Utility” column).[2] |

| County property-tax operations levy | None for general operations (county relies on sales tax).[8] |

| Who bills/collects property tax? | Christian County Collector (mailed Nov; due Dec 31).[4] |

| Assessment ratios (MO) | Res 19% · Comm 32% · Ag 12%.[5] |

| Commercial real estate surtax | 0.34% of assessed value (countywide).[6] |

Sources

- City of Ozark — “8.35% Sales Tax Breakdown” (2.375% city allocation). PDF | City FAQ confirms 8.35% and city share 2.375%: FAQ

- Missouri DOR — Sales & Use Tax Rate Tables, Jul–Sep 2025 (lists Ozark base 8.35%, CIDs/TDDs incl. Town & Country Village 10.35%, use-tax totals 5.225%, and unincorporated county rates). PDF (p. 77)

- City of Ozark — “Tax Information” (city does not bill/collect; property tax via county; businesses remit sales/hotel/motel to state). Link

- Christian County Collector — statements due upon receipt; delinquent after Dec 31 (site billing info). Link

- Missouri State Tax Commission — assessment ratios (Res 19%, Comm 32%, Ag 12%). Link

- Christian County Assessor — “Calculating Estimated Property Taxes” (commercial surtax 0.34%). PDF

- Ownwell — Ozark, MO property tax snapshot (median effective rate and bill/value). Link

- Christian County — Basic Financial Statements (FY 2023) noting no general-operations property-tax levy; sales tax funds operations. PDF

Also helpful: MO DOR sales/use portal & address lookup — Link.

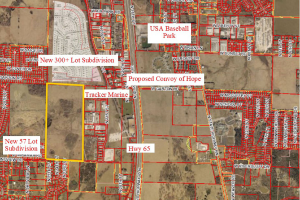

Available Buildings & Land for Development

Available Buildings:

1551 W Skyline

For Lease:

Flexible Office/Warehouse Space | 1 space available | 7,000 SqFt

Location: Ozark

Willow Terrace Warehouse

For Lease:

Size: Industrial | Multiple | 2,500 sq. ft. – 22,500 sq. ft.

Location: Ozark

Available Land:

Disclaimer: The properties listed on this website are provided for informational purposes only. We do not endorse or guarantee the accuracy, completeness, or suitability of any listing. Additionally, we do not receive any kickback or compensation for realtor listings. Any transactions or agreements made based on information from this website are solely between the parties involved. Users are encouraged to conduct their own due diligence and consult with qualified professionals before making any decisions or commitments.

Check out other Regional Properties

Explore additional properties in the Springfield and Branson areas right here.

Anything catching your eye?

Give us a call or fill out the form below! We'd love welcome you to Christian County for a site visit and show you everything our community has to offer your business.

Committed To Christian County

At SMCC, we are much more than a resource for businesses; rather, we are a partnership, dedicated to the continued and lasting development of our beautiful, innovative, and expanding county.

Show Me Christian County · 417-212-0699 · info@showmeccmo.com